We all want to achieve significant things in our lives, and let’s face it, most of them require money.

For us women who juggle our careers, our family and everything in between, time is precious and when time is constrained, we drop or at the very least procrastinate in putting a well-organized and holistic financial plan in place. But that’s also when we increase the risk that our most valued goals will become derailed.

Regardless of your personal and financial circumstance, financial planning for women is essential. The very essence of financial planning is creating the right personal strategy so you manage your money in the most effective way to create financial security and achieve the goals that matter most to you.

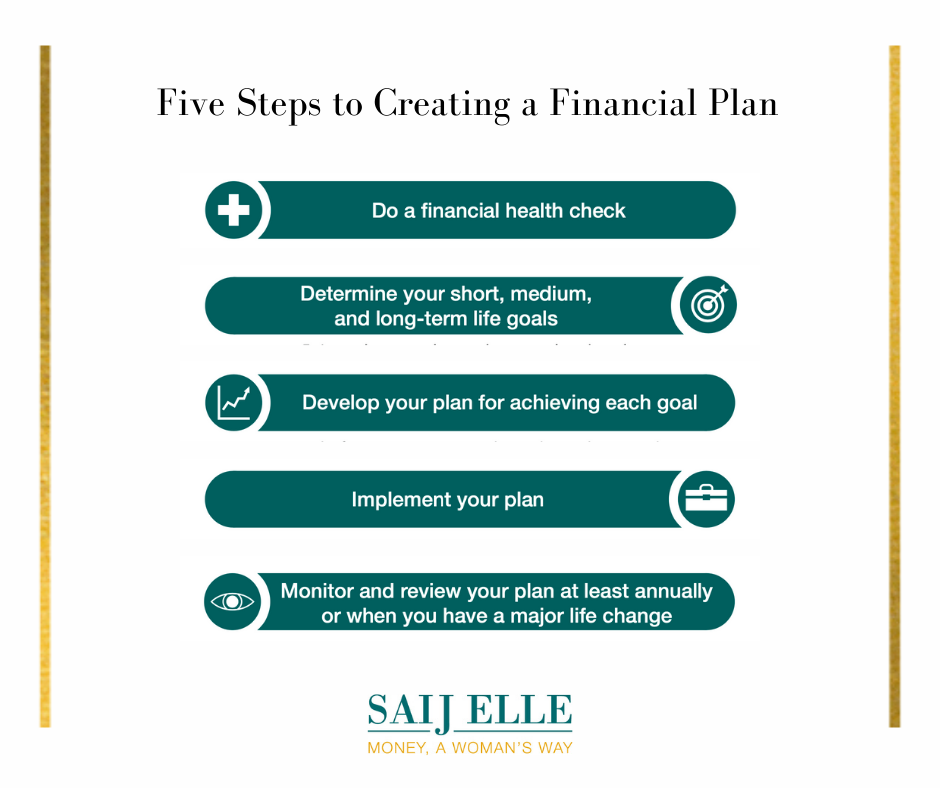

Here are the five key steps you need to take to create a financial plan, followed by your personal financial planning checklist:

Step 1: Do a financial health check

You need to know your starting point, that is what resources you have and will need to achieve your goals.

- Calculate the current value of your assets (i.e., cash, investments, property, value of jewellery, fine art etc.)

- Calculate the current value of your liabilities (i.e., debt, mortgage etc.)

- Subtract your liabilities from your assets to get your net worth

- Understand where your cash goes (by creating a budget and reconciling it) to get a ball park idea of your net monthly income and potential savings

Step 2: Determine your short, medium, and long-term life goals

Make a list of what you want to achieve.

You can start with just a few goals or make a list that’s more comprehensive. Group them by timeline (2 years or less, 2 to 5 years, and 5+ years) so you mentally know which ones will be more urgent and which ones will require longer-term planning.

- Estimate the approximate cost and target date to reach each goal

- Evaluate how close you are to achieving your goals

Step 3: Develop your plan for reaching each goal

Once you know what you want to achieve and what resources you’re working with, make a well-thought-out plan to reach each of your goals.

- Evaluate how much of your current assets will be used towards your goals

- Determine the amount of your disposable income or savings you can put away on a regular basis towards your goals

- If you’re short on funds, review your plan to see where you can make adjustments (For example, where can you cut expenses, or find alternative sources of income? Can you change your goal timeline?)

Step 4: Implement your plan and put protective measures in place

Make arrangements to execute on your plan.

Be sure to add some flexibility and padding room in case your plans change, because almost inevitably, they will. And strongly consider putting in protective measures because when unforeseen events happen, they can derail your savings and investment progress.

- Pay yourself first. Set up auto savings and auto investing through your bank, investment house of choice and/or your employer

- Have stop-gap measures in place so you’re not taking on excessive debt

- Review whether you have adequate life, health and critical illness or disability insurance and if not, purchase enough to fill the gaps

- Create your estate plan and at the very least have a will in place

Step 5: Monitor and review your plan at least annually or when you have a major life change

All financial plans, including financial planning for women is meant to be fluid and will change as your life circumstances change.

With major life events such as a change in career and financial situation, having children, or a change in marital status, your priorities may also change and a goal that seemed fitting may no longer suit you.

- Review your goals to make sure they’re still important to you

- Check that your progress in reaching them is still realistic

- Review the below financial planning for women checklist below this infographic and make adjustments if needed

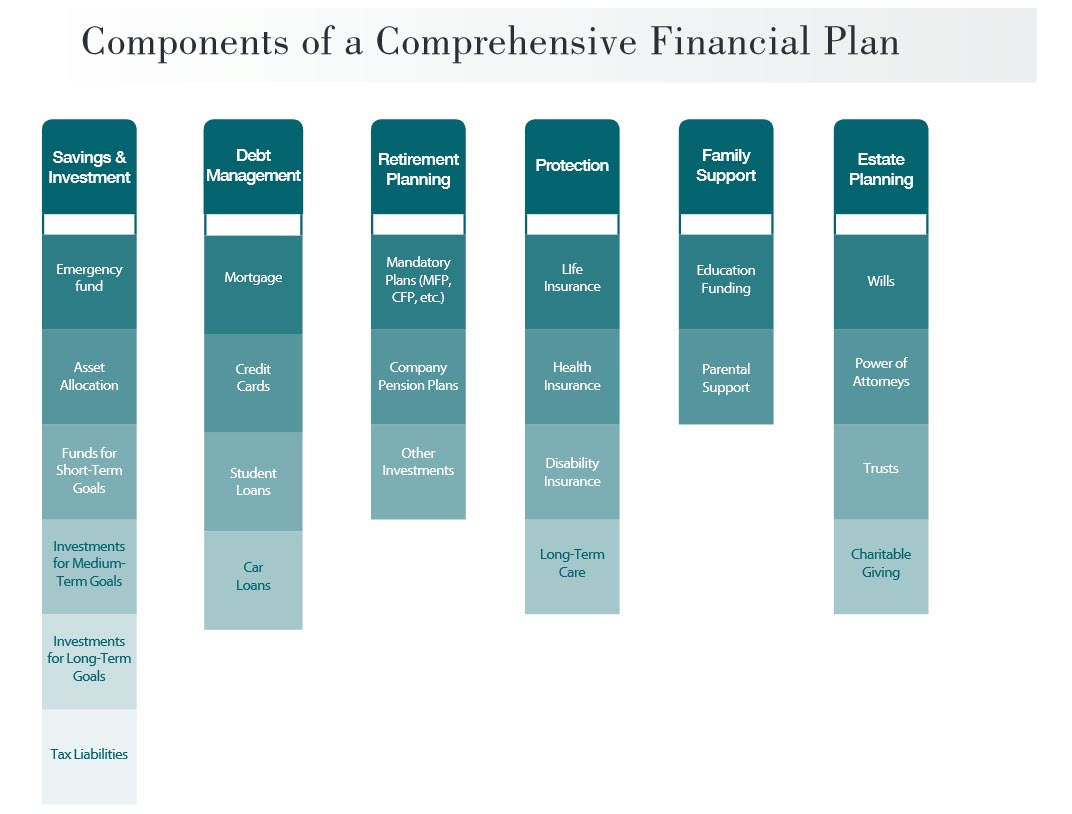

Saij Elle’s Ultimate Financial Planning for Women Checklist

Savings/Investments

⧠ Do you have an emergency fund? (3-6 months of monthly salary recommended)

⧠ Will you have savings or investments that are relatively liquid and aimed to help you meet short-term goals? (less than 2 years)

⧠ Will you have investments designed to help you meet your medium-term goals? (2-5 years)

⧠ Are enough of your investments such that they’ll help you to meet long-term goals such as retirement? (greater than 5 years)

⧠ Do you believe your current asset allocation matches your investment needs and risk tolerance? Review your investment portfolio on your own or with your advisor and determine whether you need to adjust it.

Debt Management

⧠ Do you have a plan for paying off your debt?

⧠ Are you sure you have the lowest interest rates on consumer debt? Can you negotiate lower rates?

⧠ Do you know what your credit rating score is, and do you know how to protect or improve it?

⧠ When will you need to refinance your mortgage?

⧠ Do you need to consider a debt restructuring plan to improve your cash flow situation?

Retirement Planning

⧠ Do you have a vision for your retirement and how you’ll spend your time?

⧠ Have you calculated how much resources you’ll need to set aside for an annual retirement income?

⧠ What sort of retirement investment plans do you currently have?

- If you have an employer-sponsored plan, do you know what type of plan it is? Are you maximizing your allowable contribution? Are you investing in assets that are suited for your retirement goals?

- Are you taking full advantage of government pension programs and do you know how much government support you’ll get in retirement?

⧠ How will you make up for any shortfall?

Tax Planning

⧠ Do you have a strategy in place to minimize your taxes currently and in retirement?

⧠ Are you taking advantage of tax shelters?

⧠ Do you understand how your investments are taxed?

⧠ Do you know the tax implications of your estate?

Protection

⧠ Do you need life insurance? How much? What type is best suited for your situation?

⧠ Do you have health insurance? Who is covered in your family and what does it cover/not cover?

⧠ Do you need/have disability or critical illness insurance? How much? How long would you be eligible for benefits?

⧠ Do you need/have long-term care insurance?

Family Support

⧠ Do you plan to have children/more children in the future?

⧠ Have you calculated the cost for raising them?

⧠ Will you be paying for your children’s education (private and/or post-secondary)? How much will you need? When and for how long?

⧠ Do you provide or plan to provide financial assistance to your parents, adult children, or grandchildren? How much?

Estate Planning

⧠ Do you have a properly drawn-up will in accordance with your jurisdiction? Does it need to be updated?

⧠ If you have minor children, do you have guardians named for them? Do you have a trustee for the estate?

⧠ If you were to pass away suddenly or become incapacitated, do your loved ones understand your wishes?

⧠ Do you have a power of attorney (PoA) in the event you can’t make important decisions?

⧠ If you own a business, what kind of succession plan do you have?

⧠ Are there charities you would like your estate to support?

⧠ Who has a copy of your will and PoA? Is it in a safe place?