Are you tired of being a slave to credit card debt?

Do you want to wipe the slate clean and build a fat cash balance in your bank account?

Do you want to know how consolidation of credit card debt really works?

Then this article is for you.

I’m going to give you seven best ways to pay off credit card debt and outsmart credit card companies at their own game:

Why is Credit Card Debt Bad?

Before I share my tips, I believe it’s important to explain why paying off your credit card debt or consolidating credit card debt is important, and the negative impact it can have on your financial life and emotional wellness.

I have a love-hate relationship with credit cards.

I understand why women believe they are a necessary evil.

- They’re pretty easy to get

- The approval process is often given on the spot with very few checks done

- The issuer gives all sorts of “incentives” like rewards points, free gifts and low or 0% interest for a short period of time

We are sold the importance of having a card to build up a credit history. And once it’s in our hands, we essentially have access to spend with convenience.

But, it’s not free money. Whatever you purchase, you have to pay for. Credit card companies give you a 20-25 day interest-free window to pay for what you bought after which they ding you with high interest for essentially borrowing money from them to fund what you bought.

That interest can be anywhere from 18-25% a year on the entire balance owing.

If you don’t think that’s bad, then ask yourself if you’d be willing to pay that level of interest on your mortgage. Or if you could easily make that type of return on an investment.

The interest you’re paying to the credit card company and bank is making them and their shareholders rich. It’s money you’re giving up to build wealth.

If you’re primed and ready to erase that credit card balance once and for all, and regain control over your finances, here are seven best ways to pay off credit card debt:

How to Pay Off Credit Card Debt #1: Get Clarity on Your Spending Habits

You can’t change what you can’t see.

Research shows that we grossly underestimate our spending over any given period. For example, if I were to ask you how much money you spent and on what in the past seven days, you’d probably omit 30-40% of the items.

That’s why it’s very important to gain awareness of your spending habits. I recently coached a woman on building her financial confidence and one of the exercises she had to undertake was to understand where her money was going. She was shocked at how much she was spending on eating out and lattes. Once she was aware, she made a conscious decision to cook more meals at home, recognizing it would save her at least $300 a month!

Go through the past three months of your credit card statement and highlight how much of your purchases were necessities vs wants. (Mark a “N” or “W”).

Another method of getting clarity of your spending habits is to take photos of everything you spend money on for a few days. I can assure you that you will quickly see patterns and identify saving opportunities.

How to Pay Off Credit Card Debt #2: Create a Budget

A budget helps you prioritize where you should or need to be allocating your money, and prevents you from overspending on things that are less of a priority.

Many people find creating a budget off-putting, thinking it’s time consuming or believing it’s too restrictive, but if you do it for a few months, you’ll quickly see the benefits far outweigh the cost of inconvenience.

You’ll feel more in control, you’ll have peace of mind, and you’ll reach your goals (which includes paying your debt off) a lot faster.

How to Pay Off Credit Card Debt #3: Pay More Than the Minimum Balance

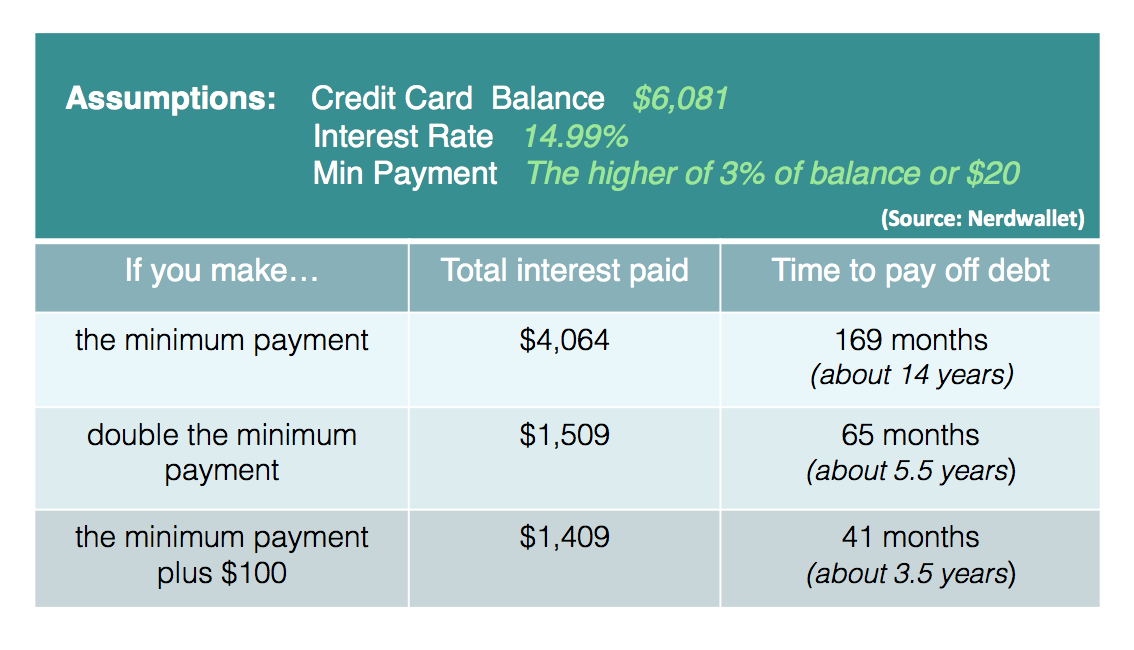

While you may be tempted to make the minimum required payment on your credit card balance, doing so will cost you A LOT in interest payments and may take you several years to pay off the balance.

That’s years and money that you can use towards better things!

By using a calculator for credit card debt, you will be astounded at how much interest you’re really paying over time.

Just by increasing your payments slightly, you can save thousands of dollars in interest and shave off years in cleaning up your debt.

So, get aggressive in paying off your credit card debt. It’s short-term pain for long-term gain.

How to Pay Off Credit Card Debt #4: Replace the Credit Card with Cash

Of course, if you’re going to pay down the outstanding balances on your credit cards, the last thing you should do is make more purchases using your credit card, right?

Of course, if you’re going to pay down the outstanding balances on your credit cards, the last thing you should do is make more purchases using your credit card, right?

Halt using your credit card and use cash.

By using cash, you will spend a lot less because human psychology tells us that we hate parting with physical cash.

So, you’ll be less tempted to spend. And, you’ll be much more aware of what you’re spending your hard-earned cash on.

How to Pay Off Credit Card Debt #5: Consolidating Credit Card Debt

Consolidation of credit card debt is a strategy that takes multiple credit card balances and combines them into one monthly payment.

Consolidation of credit card debt is a strategy that takes multiple credit card balances and combines them into one monthly payment.

It makes sense only if the interest rate on the new card or loan comes with lower interest so you can save on the total interest paid and pay off the balance faster.

There are a few methods to consolidating credit card debt:

Apply for a Debt Consolidation Loan

- Reach out to your local bank or credit union and request a debt consolidation loan. Be aware of the interest payment you’ll pay as well as the payment terms. There may be an origination fee that can also add to the costs.

- The pros to doing this is that it cuts the number of credit cards payments you have to keep track of and minimizes the chances of making a late payment which can hurt your credit score.

Leverage Low-Interest Balance Transfers

- Many credit cards offer a low or 0% annual percentage rate (APR) on balance transfers for a limited time period.

- By moving your balance from a high-interest credit card or cards to a lower interest rate, more of your payment will go towards paying down the principle of the balance rather than paying off interest – so you pay down your overall credit card debt faster.

There are several caveats you need to be aware of before considering whether consolidation of credit card debt this makes sense:

- You’ll need a good credit history to qualify

- The amount you’re allowed to transfer to the balance transfer card will be capped at the credit limit, meaning you may not be able to transfer the full amount of your balance. It’s still may be better than nothing

- The transfer card will likely charge you a fee (normally 3-5%) of the balance in exchange for the transfer

- Once a no-or low-interest introductory offer is over, the interest will accrue on the balance and rates may be much higher.

So, you’ll have to determine whether such a move is worth it, which is best done using a balance transfer calculator.

How to Pay Off Credit Card Debt #6: Sell Unwanted Items

Decluttering your home is a great way to raise some extra cash and put it towards paying off credit card debt.

Plus, the process of purging will make you think about your spending patterns like “Why did I buy this in the first place?”

You’ll feel less stress and create a tidier living space — a win-win.

Items such as kitchen appliances you no longer use, sporting equipment, furniture, books, clothes, CDs, and electronics are just some of the things you can sell on sites like Facebook Marketplace, eBay and Kijiji just to name a few.

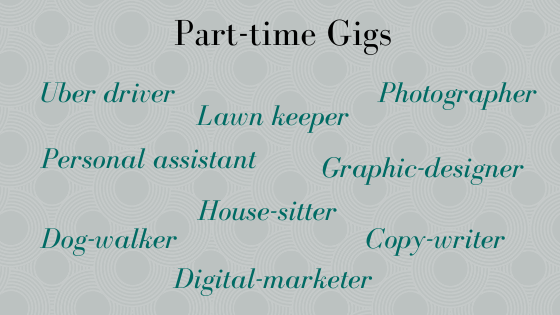

How to Pay Off Credit Card Debt #7: Take on a Side-Gig

Why not use your hobby, talent and passion to make some extra money to use towards paying down your debt?

If you can spare some time to pick up a part-time gig, do it.

You’ll be in service to others, expand your skills and experiences, and bring in cash – likely tax-free. I can’t think of a better way to shrink your debt load.

Are you tired of being a slave to credit card debt?

Do you want to wipe the slate clean and build a fat cash balance in your bank account?

Sign up for my Strictly Money online holistic financial planning program only available to women.

Let me guide you and support your financial journey!