How do you know the state of your financial health?

Personal finance ratios can provide a clearer picture of your financial situation and help you develop better habits so you improve your chances of reaching your goals.

Without doing some financial ratio analysis, you risk making assumptions.

It’s easy to assume that a person with $1,000,000 in net worth who makes $150,000 a year is financially better off than someone who has $300,000 in net worth and whose annual salary is $75,000.

But a number in isolation won’t tell you much. Suppose the person who has $1 million also has $1 million of debt.

Doesn’t sound very financially healthy does it?

It’s not what you make, it’s what you keep and it’s what you do with the money that matters.

While personal finance ratios shouldn’t be used as a “rule of law” because everyone has a unique situation, using these as guides will give you much better insight into your financial condition and pinpoint where you need to pay greater attention.

Here are nine personal finance ratios you need to pay attention to:

1) Savings Finance Ratio

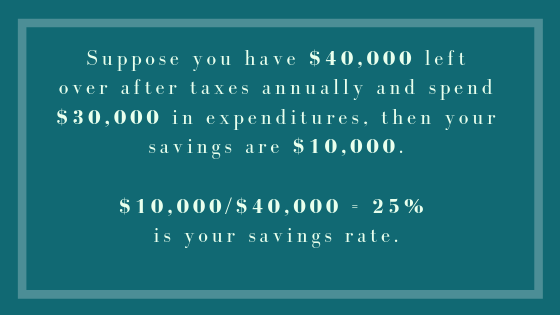

The savings ratio tells you the amount you’re putting away as savings.

Savings Ratio = Savings/After-tax Income

You can calculate your savings based on what you already have (in your savings account, fixed deposits etc.) to see if you’ve been saving enough, or you can do it on a monthly/annual basis by taking your disposable income and subtracting all your expenses to see how you’re currently tracking (housing costs, utilities, credit card & debt payments).

Rule of Thumb: A 20% savings ratio is considered a good figure. You want a minimum savings ratio of 10%. Anything less is a red flag that you’re dependent or about to be dependent on debt to fund your lifestyle.

2) Basic Liquidity Ratio

Gauging your liquidity is important because it gives you a sense of your ability to convert assets into cash quickly with little to no loss in value.

Liquidity Ratio = Cash & Cash Equivalent Assets/ Monthly Expenses

You may have heard of the importance to have emergency funds, that is money that’s safe and easily accessible to pay for unexpected and short-term costs such as broken appliances, sickness in the family, a leaky roof or as a result of a job loss.

The most liquid assets include cash, cash-equivalent securities (term deposits, money market funds) savings, and checking accounts.

Rule of Thumb: Your cash & cash equivalent assets should support your fixed monthly expenses such as groceries, utilities, rent or mortgage, and fixed loans (auto, insurance and student debt) for six months.

If you’re single or work in a niche industry that may mean it takes you longer to find an equivalent role, then aim for a liquidity ratio of 9 (or nine months).

3) 20-50-30 Budgeting Ratio

The budgeting ratio serves as a guideline on how you should allocate your income. I use the word ‘guideline’ because everyone’s situation is unique. However, if you stick to this allocation more or less, you have a very high probably of being financially secure.

Budgeting Ratio = 20% Saved, 50% Spent on Necessities, 30% Spent on Wants

- 20% Saved: The 20% savings can be towards a combination of your retirement, emergency fund or other financial goals.

- 50% Spent on Necessities: Your 50% allocated to necessities include your essential housing costs, utilities, food, transportation etc.

- 30% Spent on Wants: Think of the 30% on wants as your fun and desire bucket. You can go to the movies, out for dinner or splurge on those pair of shoes without guilt. Because you’ve taken the care of the rest.

4) Your Net Worth

Your net worth tells you how much you’re worth, or if you had to liquidate everything, how much money you’d have in your pocket.

Net Worth = Total Assets – Total Liabilities

Your total assets includes the current value of all your physical or hard assets (i.e. home, car, jewelry) as well as your monetary assets (i.e. savings, retirement funds, long term investments)

Your total liabilities includes all the debt and the financial obligations you owe at that time (i.e. mortgage, student debt, credit card debt, loans)

Rule of Thumb: Its normal to have a low net worth when you’re young, but you want to aim for growing this net worth long-term. While you may have some years where it dips, measure your trend in terms of five year chunks to see if and by how much your net worth is going up.

5) Targeted Net Worth Ratio

It’s important to strive towards financial security. And this particular ratio gives you an indication of what your worth should be after liabilities.

Targeted Net Worth Ratio= Age x (Pretax Income/10)

Rule of Thumb: If you’re 35-years old making $75,000 annually, your net worth should be $262,500. The calculation is 35 x (75000/10).

6) Debt-to-Income Finance Ratio

Debt-to-income ratio = monthly debt payments/gross monthly income

This ratio will give you and your creditors an indication of your ability to repay the money you’ve borrowed.

- Your debt payments include all money your obligated to pay on a monthly basis (i.e. mortgage, personal loans, car loans, minimum credit card payments).

- Your gross monthly income is all income sources you receive before taxes (i.e. salary, government pensions, alimony, rental income).

Rule of Thumb: A DTI ratio of 35% or less is a very good number. A DTI ratio of between 35% to 43% is manageable. Anything above 43% will be of concern to creditors.

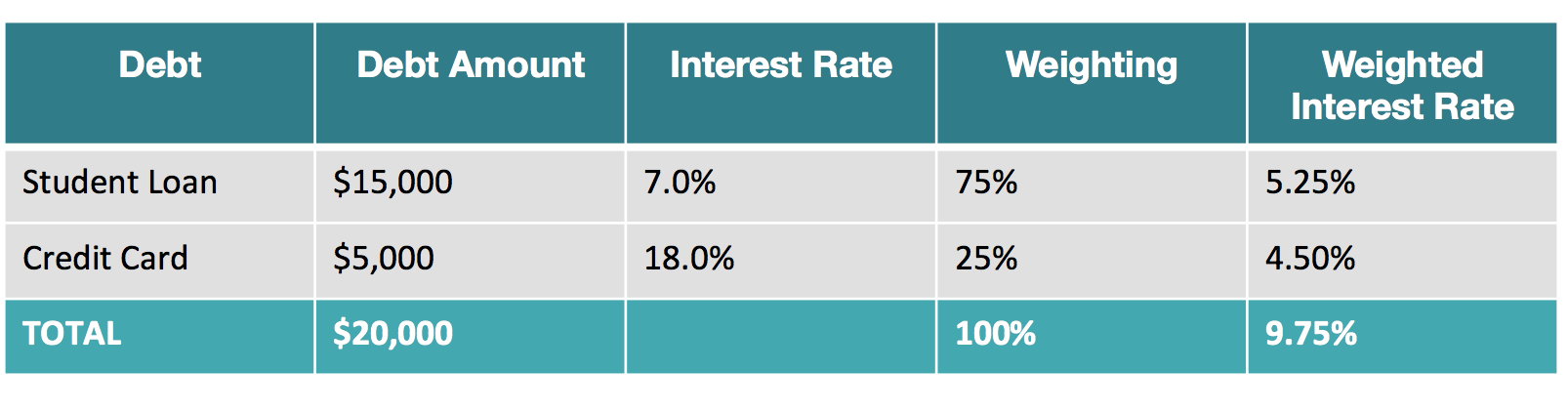

7) Personal Cost of Debt

I love this ratio because it can help you understand whether you should pay down your debt or invest – which is by far the most common question I get asked.

Personal Cost of Debt = (Amount of Loan A / Total Debt) x (Interest Rate for Loan A) + (Amount of Loan B / Total Debt) x (Interest Rate for Loan B) + ….

Here is a visual example of the way you want to calculate your personal cost of debt: Weighting: (Debt Amount of Loan Divided by Total Debt)

Weighting: (Debt Amount of Loan Divided by Total Debt)

Rule of Thumb: The long-term average for the stock market is between 5-7% so in the case above you’re much better off paying off your debt, starting with the highest interest rate debt first (credit card debt usually comes with very high interest payments).

If you can get your personal cost of debt to below 5%, you can think about investing money in the stock market or other financial vehicles.

8) Mortgage Finance Ratio

Buying a home will arguably be the most personal and biggest financial investment you’ll make. Unfortunately, with home prices surging, many people are overpaying for a home and putting their financial security at risk.

Mortgage Ratio = 2.5 gross income x Primary Income = Mortgage

This is a simple ratio that indicates how much you can take on for a mortgage.

If your household gross income is $150,000 annually (reasonable for dual-income earners), you should not borrow more than $375,000.

Typically, you’d be required to put 20% down, so based on that, your home shouldn’t cost more than $470,000.

Rule of Thumb: Remember, it’s what you can afford, not what the mortgage lender says you can afford.

9) Life Insurance Ratio

If you’re dependent on someone’s salary for your lifestyle and to reach your financial goals, OR if you have dependents, then having life insurance is an important consideration.

Life insurance can help cover daily living expenses for those left behind, pay off debt, and even cover funeral expenses.

While calculating your need requires more analysis, a quick rule of thumb is to purchase about 10 times your annual income for coverage.

Life Insurance Ratio = 10 x Primary income

Rule of Thumb: If you make $100,000 a year, this finance ratio indicates that you get a $1,000,000 policy.

Of course it’s important to consider your family’s particular needs. If you have young children who may want to attend college, or if you have a larger family home and fixed expenses, this amount may make sense. It may, however be excessive for a single person or someone with grown children.

The type of insurance you need will also be important. Read more about what you should know about life insurance.