Do you have the travel bug? Are you someone who loves exploring the world and experiencing different cultures?

EXCEPT… you feel like you can’t afford to do it?

It can feel daunting to save money for travel, especially if you’re already on a tight budget. But it needn’t be.

Here are five tips that will have you travelling the globe and making life-altering memories in no time.

Tip 1: Make Your Goals S.M.A.R.T:

There’s a saying, “A goal without a plan is a wish”. If you want something, you have to set out a plan to get it right?

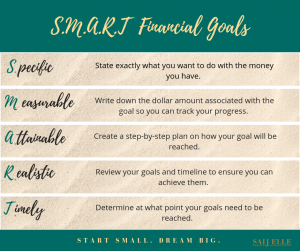

Below, you’ll find how to set a goal that is S.M.A.R.T –that is Specific, Measurable, Attainable, Realistic and Timely.

Suppose you want to go to Italy next year. An example of your S.M.A.R.T goal could look something like this:

Specific: I want to explore Rome, Tuscany and Milan in Italy for 7 days in June 2020.

Measurable: I expect the total costs for travelling there including airfare, Airbnb, food and tours will cost me US$2,300.

Attainable: I already have $300 saved. In additional to that, I will put away $170 a month for 10 months.

Realistic: Saving $170 a month is doable, however I will monitor my progress every month. I may need to find ways to save extra money if I fall behind.

Timely: In order to get the best price for flights and accommodations, I will have needed to save most of my money by March-end 2020.

Tip 2: Set Up a Dedicated Travel Fund

These days, many banks allow for multiple savings accounts under a primary account without extra fees. Find out of this applies to you because this is where you can create your dedicated “travel” account and set up a system so you’re transferring a set amount into that account on a frequent basis (i.e. weekly or monthly). Setting up an automatic transfer will prevent you from spending the money or having to mentally keep track of how much you have to save, especially if you’re not a fan of tracking budgets.

Tip 3: Find Ways to Save Money

Once you know how much money you’ll need to set aside for your vacation, it’s time to get creative on how to actually save money.

Difficult you say?

I can promise you, that once you look closely at your spending habits and mindfully align it to your inner values, you’ll find many pockets of “overindulgent” spending.

Here are some areas where you’re most likely to be able to reign in excess spending:

Eating Out – Spending money on lunches, dinners and even coffees add up very quickly and yet for many, has become a ‘normalised” habit. In a place like Hong Kong, where food prices are at a premium, a handful of dinners out, and a daily coffee habit can easily add up to US$300-500 a month.

Instead, try cooking more meals at home and saving leftovers for lunch. Brew your own coffee and take it into work once in awhile.

Entertainment – Why head out to a movie when you can order a good one on Apple Tv or watch your favourite series on Netflix? Do a book swap and spend some time reading. Or instead of indulging in a boozy weekend brunch, why not head out for a big hike and picnic at a scenic spot with friends?

Gym Memberships – I’ve found that unless you’re going to the gym several times a week, you’re probably not getting value out of your gym membership. You may want to consider putting your membership on hold for a few months and exercising outdoors, or joining a group class once a week that will be more fun and save you some cash temporarily.

Remember that cutting back on costs doesn’t need to feel like a huge sacrifice. Rather, it’s about making trade-offs and giving up something you value less for something you value more.

Tip 4: Visualize the Prize

When you’re planning for a vacation that feels forever away, it can be easy to get sidetracked. Because let’s face it, saving money is a drag.

What will help you stay on track is visualizing your trip? Think about the adventures you’ll take, the food you’ll eat, the interesting people you’ll meet, and especially the fantastic stories you’ll bring back home with you. Put a photo of your destination on the fridge along with a list of top ten things you’ll do or a quote to serve as inspiration.

I’m a huge believer in visualization because it helps the mind attract the resources and energy needed to succeed.

Tip 5: Leverage Holiday Websites & Apps

As you get a few months closer to your holiday, you’ll find plenty of websites and apps that will help you save money on your airfare, accommodations, transportation when there, and tours.