Saving for retirement can be tough. With so many competing financial goals, many people fall into the trap of believing that they have lots of time to plan for their golden years. And then…before they know it…they’re scrambling to catch up. Sound familiar? A 401k plan is a retirement savings account that helps you grow wealth tax-advantaged. Learn how it works, contributions, and employer matching.

This is why employers can play such a vital role in supporting their workforce in preparing for retirement.

According to the U.S. Bureau of Labor Statistics (2023), 57% of private-sector firms with fewer than 100 workers offered a retirement benefit plan, while 86% of companies with 100 or more workers—and 91% of firms with 500 or more workers offered it.

While most companies offer traditional 401(k) plans, adding Roth 401(k) options have gained rapid popularity. In fact, some 93% of 401(k) plans now offer a Roth account.

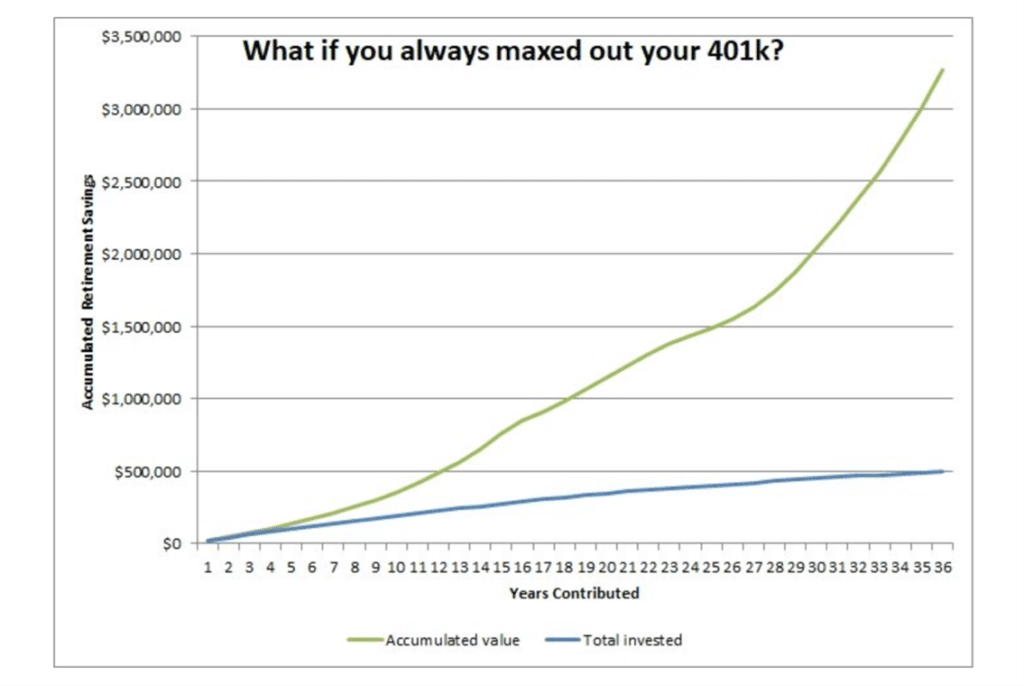

A 401(k) plan is no doubt, a powerful retirement savings tool offered by employers to help employees save and invest more easier for their future. That’s because it provides a structured, tax-advantaged way to build wealth over time.

What’s unfortunate, however, is that despite its importance, many Americans are not making the most of it.

Typically, only about half of U.S. workers (56%) – full and part-time, participate in a retirement plan at work. A lot less are maximizing its use.

So, what’s the problem you may ask.

A lack of financial education

Many employees don’t fully understand what a 401(k) plan is and how it works. They’re unsure how to use it to their advantage.

Employers are often just as guilty of not providing adequate education, leaving employees to fend for themselves. To complicate matters, there are several misconceptions around contribution limits, tax implications, and the best investment strategies to use for one’s personal circumstances and preferences.

Why Saij Elle Is Stepping In

At Saij Elle/Saij Wealth Consulting, we’re stepping in to bridge this knowledge gap. Through workshops and our online financial education programs, we’ve witnessed firsthand, how empowering employees to make informed decisions about their retirement savings can make a profound impact on their wealth, productivity, job satisfaction and stress levels.

What’s a 401(k) and How Does It Work?

A 401(k) plan allows employees to contribute a portion of their salary to a retirement investment account through an employer-sponsored program. Contributions can be made on a pre-tax basis using a Traditional 401(k), or on an after-tax basis through a Roth 401(k).

There are several benefits in using this plan

The biggest of which are the tax advantages. Investing inside a Traditional 401(k) and Roth 401(k) allow for investment returns to grow tax-free. In addition, contributions to a Traditional 401(k) are tax-deductible and reduce your taxable income for the year, whereas Roth 401(k) contributions are taxed upfront, but any withdrawals including the growth portion, are tax-free.

Most employers will also offer matching, meaning they will match your contributions up to a certain amount. One may not think this is important and many employees do not take advantage of this, but this is essentially “free” money that gives them an immediate return on investment.

Because 401(k) plans pool money from many employees, the management fees (MER) to run the investments are lower than what individuals might pay with a retail account. This provides an extra boost to one’s yearly portfolio return and supports the power of the compounding effect.

Also underappreciated is the setup. Contributions to these plans are automatically deducted from your paycheck – a concept that makes paying yourself first and saving effortless.

Contribution Limits

Contribution limits for a 401(k) are quite generous in relation to other retirement plans such as the IRA. For example, one can contribute up to $22,500 in 2025 if they are under 50 (including the matching portion). Those 50 or older can make an additional catch-up contribution of $7,500, for a total limit of $30,000.

It’s important to note that 401(k) plans do NOT allow carry-forward of unused contribution limits from previous years. If contributions are less than the annual limit in a given year, the employee loses that unused amount, and they can’t roll it over.

There are no retroactive contributions either, meaning they can’t go back and make contributions for previous tax years once the calendar year is over.

Roth vs. Traditional 401(k)

This is the number one question we get

The use of traditional plans are still by far, the most popular with 80% of participants using it.

However, the uptake of Roth plans has grown. Almost 28% of workers participating in 401(k) plan made Roth contributions in 2021, up from 18% in 2016, according to the PSCA.

There’s no wrong or right decision as to which to use. It comes down to the one that’s best suited to the individual and that depends on a few factors.

Taxes is the biggest factor! Whether an employee chooses Traditional or Roth usually comes down to their current tax bracket and their expected tax bracket in retirement. The aim is to keep more money in the bank account and give less away to Uncle Sam.

The challenge can be that one’s life and financial circumstances can change, and no one really knows how tax legislation can evolve in the future.

However, here are some considerations:

Typically, those who are just starting in their career have a lower salary then what likely will be the case in the future and that means lower tax rates. In this situation, tax deductions are less beneficial and so contributing to a Roth would make sense.

However, there are many Americans who are struggling to save anything and live paycheck to paycheck. For them, getting an upfront tax break by contributing to a Traditional 401(k) can make the difference of saving towards retirement or not saving at all.

An employee who’s in a high tax bracket can go either way. Contributing to a Traditional will give them a welcome tax break upfront however, if they expect to be in a higher tax bracket during retirement, they will face a bigger tax burden when they begin withdrawing funds. If they expect their tax bracket to be reduced when they retire, sticking to Traditional may make sense.

Where contributions to Roth 401(k) becomes attractive is when a high-net-worth employee is also using the Individual Retirement Account (IRA).

This is because individuals earning over $150,000 or couples earning over $236,000 are not allowed to have a Roth IRAs (2025 contribution limits). If they are seeking a balanced approach, using a Roth 401(k) is their only option.

Why Contributions Are Not Enough

Your 401(k) plan is only as effective as the investments you choose. Many employees mistake contributing to their plan as actually investing. Without picking investments, their contributions are sitting idle as cash and not earning a tax-free return.

Building a proper investment portfolio inside the 401(k) plan is key and needs to consider balancing risk tolerance and risk capacity, as well as aiming to earn returns that will build enough wealth to live on during one’s 20-30+ years in retirement.

The problem we’ve seen at Saij Elle/Saij Wealth Consulting is that the majority (90%) of employees do not know how to create their own personalized portfolio. This is an area we support and educate companies on.

The Bottom Line

A 401(k) plan is a valuable tool for building long-term wealth, but its success depends on how well you understand and use it. At Saij Wealth, we’re here to help you make sense of your options and build a financial future you can feel confident about. Reach out if your interested in a workshop or our financial wellness programs