How can women find a trustworthy personal finance expert for women in Canada?

When prioritizing your financial future, it’s important to find a trusted authority. Look for someone with both professional financial credentials and a proven track record of working with women’s unique financial needs, not just someone who regurgitates concepts from a book or shares trendy money tips on social media. Our guide will help you know what to look for (and avoid).

Why Good Financial Advice Matters

There’s no doubt that the popularity and accessibility of social media platforms has driven the rise in financial influences (a.k.a “finfluencers”). At the same time, millions of people are seeking financial advice that’s free, and taking comfort in someone whom they believe understands their challenges and goals and is relatable.

But that unquestioning trust can come with risks. A recent survey by the Ontario Securities Commission found that 35% their respondents made a financial decision based on advice from a “finfluencer”. Those respondents were 12x more likely to have been scammed on social media and were 2x more likely to have experienced significant investment losses in the past.

It’s important to remember that “finfluencers” are not regulated and will face little if any consequences for bad advice, unlike a qualified advisor or a personal finance expert holding credentials.

For women, the stakes are higher. They face unique financial challenges (e.g., pay gap, lower labour participation, lower pensions) that already make it harder for them to build wealth, and research shows they are less confident about making financial decisions compared to men. It’s even more important for females to get qualified guidance.

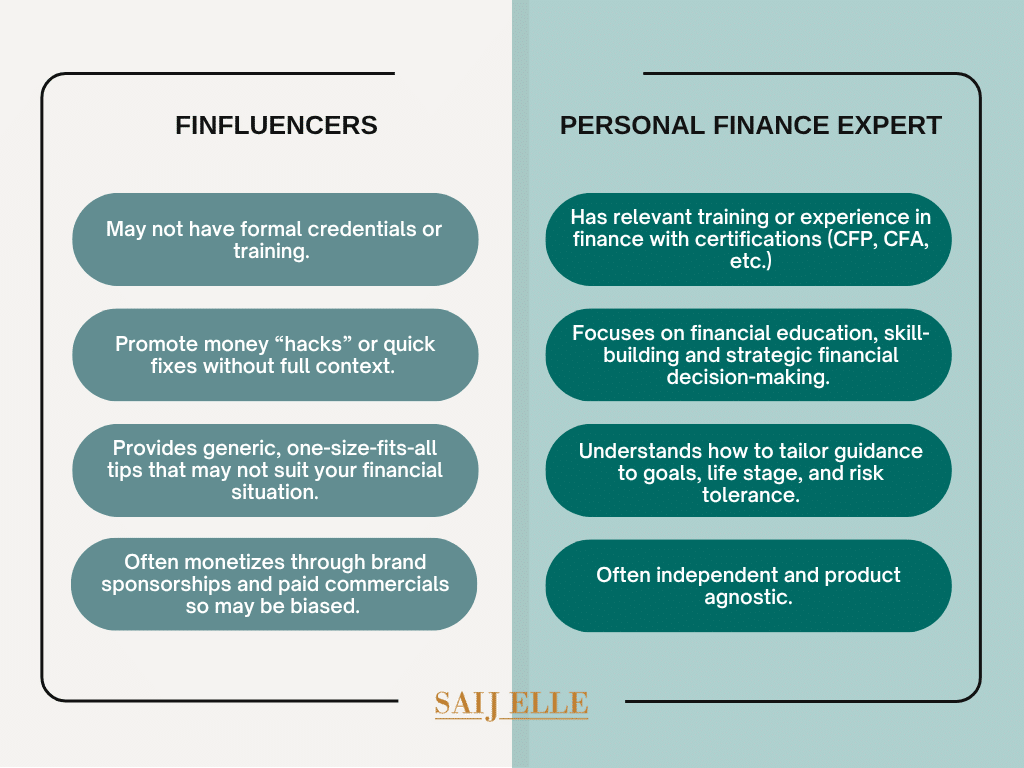

Comparison: Influencer vs. Personal Finance Expert

Quick Tip: If someone is pushing a particular product or financial company or makes bold promises, dig deeper.

What to Look For in a Personal Finance Expert for Women in Canada

First, let’s define and differentiate a “finfluencer” vs. a personal finance expert.

A “finfluencer” is a person who, simply because of their popularity, can influence the financial decision-making process of others through promotions or recommendations on social media. But they may not necessarily have formal credentials and training, a very important distinction compared to a true personal finance expert.

Imagine taking advice from a medical influencer versus a trained doctor on a health issue, especially for a serious and complicated condition. The impact could be profound.

While a “finfluencer” can inspire their followers to take an interest in money management, and while not always intentionally harmful, they could pose a risk to investors because of their lack of experience, siloed or poor advice, or ulterior motives.

A personal finance expert will have proven and relevant training and credentials in the area they are providing advice such as having a Certified Financial Planner or Chartered Financial Analyst designation. They will be experienced in providing strategies based on women’s personal situations and be able to guide a thoughtful discussion.

A true expert in personal finances shouldn’t be swayed by a particular company’s product or solution, especially if their primary objective is to educate their followers.

Here are some common questions Canadian women need to ask to determine whether the social media star they follow are “finfluencers” or personal finance experts.

1. What are their credentials—and do they reflect real financial expertise?

Saying they “worked on Bay Street or Wall Street” isn’t enough. Were they in a client-facing role? Did they manage money, give financial guidance, or help people build wealth?

What to look for:

• Financial certifications like CFP®, CFA®, FCSI®, or PFP®. They will be bound my ethics and rules through these organizations.

• Degrees in finance, economics or accounting.

• Experience in wealth management, financial planning, or investment management.

Check their LinkedIn for specific job roles—not just companies. Titles like “analyst,” “advisor,” or “planner” carry more weight than admin and marketing roles. Look at their testimonials: Do other respected experts in the field endorse or collaborate with them?

2. Do they answer financial questions with nuance—or just soundbites?

Real experts understand that money decisions depend on your life stage, goals, income, and much more. Every situation is unique so if their answer is a one-size-fits-all solution, or if they recommend a particular stock, be cautious.

Look for:

• Phrases like “it depends,” followed by thoughtful clarification

• Questions that encourage you to reflect on your own situation

• A clear distinction between education and advice

3. Are they selling quick wins or helping you build long-term confidence?

Beware of promises that seem too good to be true and too easy such as “retire by 40,” “get rich passively,” or “invest in crypto or this stock and double your money.” If they claim they became rich overnight especially without showing any prove, or try to sell you a lifestyle by taking glam photos, you need to think twice about their intentions.

Look for:

• Realistic, long-term thinking and planning

• Strategies that are rooted in good habit and discipline, not pressure and quick fixes.

• A focus on helping you build financial knowledge and skills, not chasing fads

4. How do they earn their income and are they transparent about it?

If someone’s promoting a trading platform or a banks’ funds every week, ask why. Are they being paid? Are they being influenced with free gifts? Do they disclose this? Real experts are upfront about how they’re compensated.

Look for:

• Transparent disclaimers about partnerships or affiliations, or photos tied to the company for signs of “soft influence”

• Honest comparisons (not just hype) when recommending tools, platforms or products.

• Guidance that isn’t tied to selling a product

5. Are they focused on one narrow area or your whole financial picture?

There’s nothing wrong with talking about side hustles or saving tips but real financial empowerment takes much more than budgeting or having a job. Financial independence and wealth strategies need to incorporate saving, managing debt, minimizing taxes, protecting income, and retirement planning.

Look for:

• Content that touches on a range of financial topics

• A holistic approach to financial wellbeing

• Them willing to say, “This is outside my scope – here’s where you can find trusted sources on that topic.”

Final Word

’ll leave you with these few thoughts.

Just because someone’s content goes viral doesn’t mean they’re a financial expert. In fact, with only 63% per cent of men and 48% of Canadian women feeling comfortable making their own personal investment decisions, many people don’t know how to spot misleading or incomplete advice, and that includes the influencers themselves.

Understand that both “finfluencers” and personal finance experts will have limitations on what they know and how they can serve you. General advice should never be a replacement for personalized, holistic financial advice by a qualified and registered advisor.

This topic is not going away. The rising concern over how to manage finfluencers has sparked discussions and policy papers amongst regulators globally on how to protect investors. Expect regulations to come in the future. We at Saij Elle would welcome the opportunity to protect women and support their financial journey.