When it comes to creating an investment portfolio, there are literally hundreds of thousands of choices and strategies to pick from – so much so, it can be overwhelming. And let’s face it, overwhelm is what stops so many in their tracks when investing in the first place!

What if I were to tell you investing doesn’t have be overwhelming or time-consuming!

By learning some “key principles” that go into building asset allocation models, you can invest aligned to your needs simply and without stress, and avoid common mistakes so many investors make.

In this post, you’ll learn about what asset allocation models are, why they’re so important, and practical guidelines you should follow when building an investment portfolio.

What are Asset Allocation Models?

Investment portfolio allocation models are when you create a strategy to divide your pool of money among different types of asset classes in line with your:

- Goals

- Time horizon

- Risk tolerance

These asset allocation models include:

Stocks: (Also known as equities) Type of investments that entitle the holder to fractional ownership of a company and therefore participation in its growth or decline.

Bonds: (Also known as fixed income) Is a loan from an investor to a borrower such as a company or government in return for interest on the investment.

Cash and cash equivalents: Investments that have high credit quality and are highly liquid. They’re typically meant for short-term investing.

If you’re interested in learning more about how to invest in stocks, read my blog – “Four Questions to Ask Before Buying Stocks”.

Why is Asset Allocation Important?

Creating and maintaining the right asset allocation mix is arguably the most important decision investors can make, especially those with a long-time horizon. That’s because of a basic principle of investing called diversification.

Diversifying your assets primarily helps you to manage risk. You need to earn a decent return on your investments if you want your wealth to grow, but you don’t necessarily want to take a lot of risks to do it. By allocating assets in different proportions, you can enhance returns and lower overall volatility.

That’s because all investments and asset classes react to market news and economic cycles differently and to varying degrees at any given time. Stocks are generally the riskiest asset class but also potentially offer the highest returns. Whereas bonds, especially government bonds, and cash are much less risky but also provide limited growth opportunities.

Building portfolio allocation models with assets that are unrelated (or uncorrelated) to each other will help you better endure the unpredictable nature of the markets.

Read my blog on why Diversification is the most important rule in investing HERE.

What are the Principles for Investing?

Since each asset class has different levels of risk, returns, and liquidity – the percentage allocation of these assets will depend primarily on your investment objectives (i.e. when capital from your investments will be required and how much) and your comfort with volatility (i.e. your risk tolerance).

1. Your investments should align with your goals

How you diversify your pool of money needs to take into your account your life plans.

- Will you be making a big purchase such as a car or house soon?

- When do you plan on retiring and what portion of your investments do you need to fund your lifestyle?

- Do you need to generate regular income from your investments or would you forgo income for more growth?

The shorter the time frame for you needing the funds, the safer and more liquid assets your money should be in.

Conversely, if you don’t need to access the funds for 5+ years, keeping the money in something safe and earning little investment returns is not ideal. However, because the historical long-term trend of the stock market is upwards, and you’re likely to earn better returns there, it would make more sense to invest in equities.

2. Your investments should align with your risk tolerance

The bottom line is you don’t want to take risks that you’re not comfortable with.

The amount of volatility you can withstand so you can generate better returns needs to be considered when you’re building your portfolio. But so does your risk capacity, meaning there’s a certain level of risk you may need to get comfortable with to actually achieve your goals – a point not often talked about!

3. Forget about timing the market because you can’t

If only we had a crystal ball and could predict which stocks were going to get us rich!

Let me break it to you now.

No one can accurately predict which stocks are going to do well or poorly and where the markets are headed.

It’s about time in the market, not timing the market. That’s why creating an investment model portfolio that’s diversified works.

4. Review your portfolio at least annually or as a result of a big life change

Once you’ve created your portfolio investment strategy, remember to review your portfolio at least annually to see if the weightings and performance still work for you.

For example, your stocks portion may perform very well and tilt the weightings to say 50% to 60% which in turn will change the risk profile. You may want to consider rebalancing your portfolio by selling some of your equity position. Your circumstance may also suddenly change and this will warrant a review.

Investing is a key part of financial planning but not the only part. Read my blog – “Five Essential Steps to Financial Planning for Women”.

What are the Different Asset Allocation Models?

There are many different types of portfolio asset allocation models, and there are no standards that the financial industry follows. But they generally fall into three buckets.

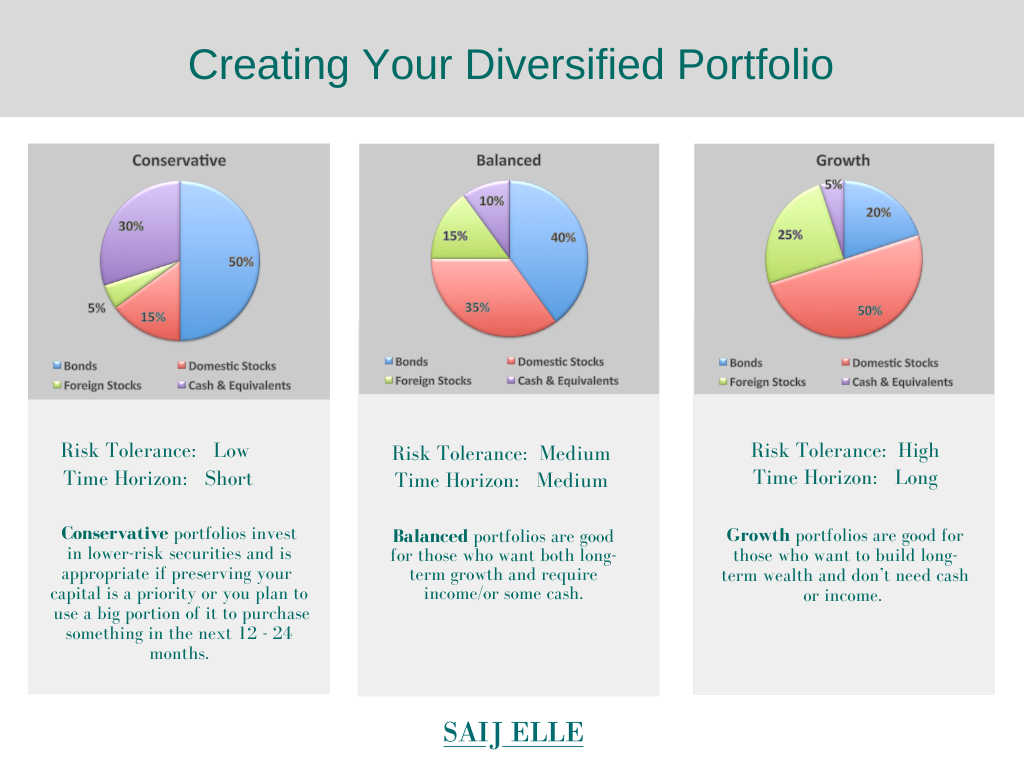

See this chart for examples of portfolio allocation models:

Use the above as guidelines and understand the “theory” behind them.

The percentage allocation you end up going with and the types of stocks, bonds and cash, (or mutual funds and ETFs) you hold will depend on your particular situation.

I can’t stress enough how important the above asset allocation guidelines are when building an investment portfolio.

This is especially important for women.

That’s because most women I know are looking for sustainable growth rather than gambling on quick wins (which can easily turn into quick losses).

The majority of women are busy juggling work and family obligations and don’t have time to monitor their investments daily – nor should they. And most importantly, women are more risk-aware and want to avoid making silly mistakes with their hard-earned money.

Building an investment portfolio that’s diverse and aligned to goals circumvents trying to time the market – which is almost impossible to do, and picking investments that don’t make sense based on your risk tolerance.

My Strictly Money program has two modules dedicated to helping women build their own unique investment portfolio and teaches them how to pick stocks, bonds, ETFs and mutual funds. Sign up today!