More and more employers are waking up to the importance of offering a financial wellness program to their staff. After all, employees are a company’s most important asset.

How they show up to work, how they perform, and how long they remain as a loyal contributor matters to the bottom line.

But make no mistake, the bottom line is also important to individuals.

Money has been a top source of stress for many years, however, the pandemic and ensuing repercussions of it (i.e., inflation, stock market sell-off, higher housing expenses) has drastically affected people’s ability to save and reach their goals, and only exasperated their anxiety.

According to the Canadian Payroll Association, 72 per cent of workers spend at least some of their workday either dealing with or thinking about their personal finances. Those who say they’re financially stressed spend, on average, 29 minutes per day worrying.

Let’s think about this…

Assuming an average salary of $50,000 and a 6% loss in productivity, that’s a cost of $3,000 per person to the company every year. Suppose a company has 150 employees, and we conservatively estimate that 35% of them are consumed with money worries – the estimated cost would be approximately $158,000 per year.

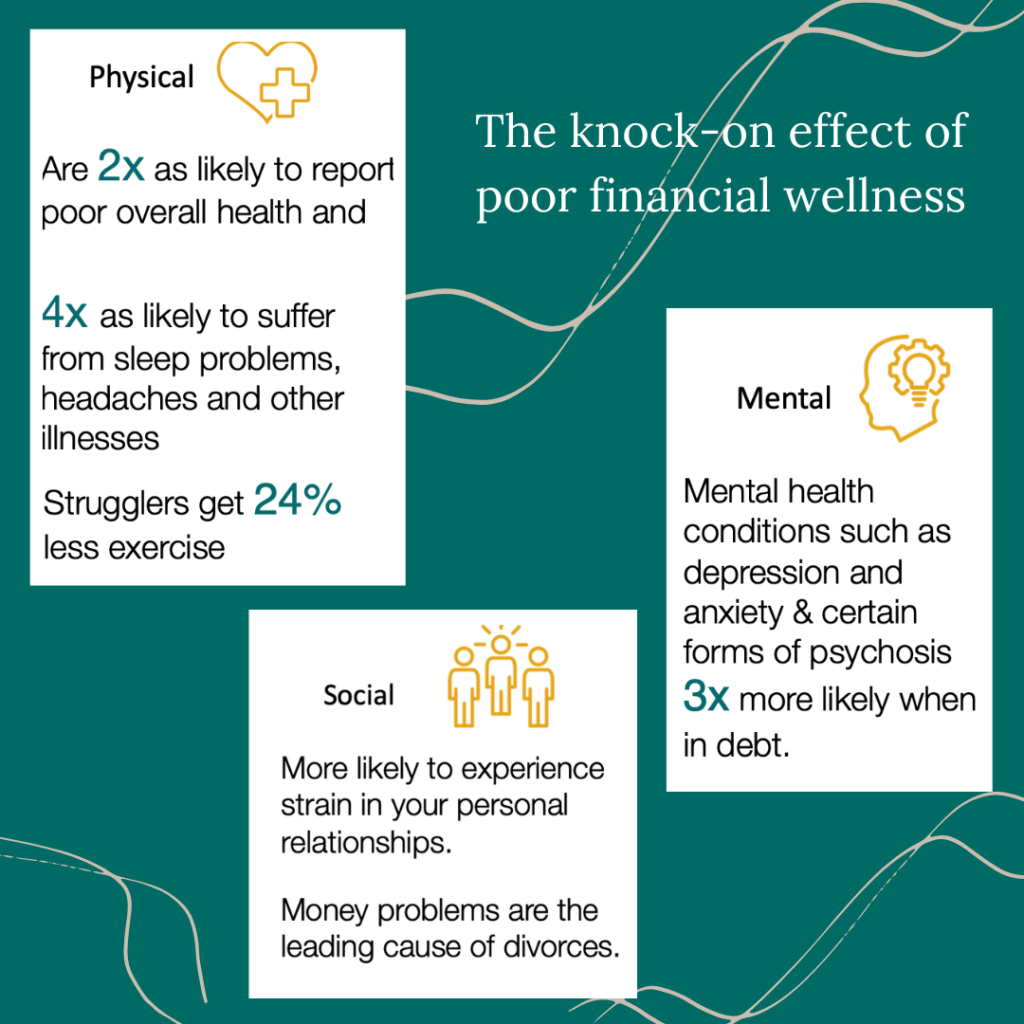

That’s just the cost of lost productivity. There’s also the physical impact of financial stress that needs to be accounted for, as can be seen below:

- Absenteeism, higher medical costs, and short-term disability are added expenses to a corporation.

- Some 16% of employees have said that financial worries have led them to look for another job.

- Recruiting and training costs as a result of turnover also need to be factored in.

The number of employee financial wellness programs has risen to 46 per cent in 2022 from 40 per cent just a few years ago. There’s no doubt that the pandemic and the great resignation has drove the need for financial wellness programs.

I’d personally like to see this figure be much higher given the win-win proposition for both the company and its staff. But I also would like to see corporations offer a financial wellness program that works.

Unfortunately, I’ve witnessed the majority of employers repeatedly make the same mistakes, thereby wasting time, effort and resources, and most of all leaving their employees more frustrated.

So if you’re running a program or thinking about introducing a financial health initiative, these are SIX key mistakes to avoid to ensure you get a good return on your investment and make a real difference.

Mistake #1: Thinking that Financial Literacy is Enough

Encouraging employees to build financial literacy is absolutely important but focusing solely on it is bound to waste your money and your employees’ time.

Sure, it’s vital to understand financial concepts to manage money but…

- what one does with that knowledge (action)

- how they apply that knowledge to their circumstances (skills)

- how they view money and manage it (attitude)

- and their belief in their capability to do what it takes (self-efficacy)

…is just as, if not more important.

Instead, address financial capability which incorporates all of the above and is far more inclusive, and you will get exponential results.

Mistake #2: Thinking One Workshop Will Do the Trick

Building financial capability is a process. Creating new habits requires repetition, reminders, and an environment that supports just-in-time learning.

For instance, if you were supporting your employees’ emotional or physical wellness, you wouldn’t have one meditation or workout session and expect them to be transformed.

Imagine being expected to do your job well after just one orientation session.

How successful would you be? How frustrated might you be?

The same thing applies to financial wellness. Running an hour webinar only scratches the surface and often leads to more questions. They learn what they didn’t know with little ability to resolve them, leaving employees even more flustered.

Learning how to manage money properly also entails a holistic and often in-depth approach. For example:

- learning how to save and manage debt

- creating and reaching financial goals

- planning for retirement

- investing

- understanding how to evaluate insurance options

- how to create a proper estate plan

…are all key aspects of financial wellness and require much more than a few hours to act on with confidence.

Mistake #3: Not Offering Personalization

Personal finance is just that – it’s personal. Like a thumbprint, every single person has a unique set of financial resources, objectives, and values.

Some of your employees will need to focus more on savings, while others will prioritize retirement planning. Some need simple solutions while others have more complex requirements.

A one-size-fits-all approach will not work.

However, what will work is delivering information that teaches them what they need to be aware of and how to apply concepts to their own unique situation – in other words, teach them “how to fish” rather than “giving them the fish.”

Mistake #4: Not Creating a ‘Safe Space’

Discussing money bring with it, a lot of stigma and shame, especially as it relates to the financial challenges people face, previous mistakes and what they don’t know.

Discussing money bring with it, a lot of stigma and shame, especially as it relates to the financial challenges people face, previous mistakes and what they don’t know.

Creating a safe space for employees to learn and engage is critical.

For example, hosting a debt management event and expecting people to attend, and admit and be open about their challenges is likely to fail in getting the results you and they want. Doing such an event online and anonymously is a better course of action.

Offering financial wellness programs online is also a great way for employees to learn at their own convenience and in private.

Mistake #5: Not Partnering with the Right Experts

It is highly unlikely that an organization will have the skill-set or structure to deliver the right employee financial wellness program, so finding the appropriate partners is key.

Raising employees’ financial capability requires the right subject matter expertise, a strong understanding of how to deliver the information with the proper channels, as well as a feedback mechanism so senior executives can see the results they’re getting and follow up on opportunities.

But partnering with the right financial wellness provider shouldn’t break the bank either.

I’ve seen far too many consultants charge a bomb to justify their team’s bloated payroll and systems that look nice but don’t get results.

And far too many organizations equate an expensive proposal or a program with all the bells and whistles as superior even though it may not be right financial wellness program for them.

Mistake #6: Thinking the Topic is Too Sensitive

Many corporations want to stay clear of financial wellness because they feel discussing money is too personal or that discussing it will encourage their employees to ask for a higher salary.

Many corporations want to stay clear of financial wellness because they feel discussing money is too personal or that discussing it will encourage their employees to ask for a higher salary.

These misconceptions are misplaced.

Money is indeed personal. So is mental health and physical illnesses.

The challenge 90% of people face is that they don’t have the capability to make better financial decisions.

In fact, most people believe that more money will solve their problems when in fact, how one manages their finances is more important than how much they have.

Did you know that 70% of lottery winners go broke and 60-65% of NBA players go broke within the first five years of retirement?

Whether organizations like it or not, as the primary source of your employees’ livelihood, they are looking to you to provide financial education.

A recent survey by TalentLMS revealed that 61% of employees would stay longer in a company because of financial wellness training, and that it leads to higher job satisfaction: 83% who got training are satisfied with their job, compared to 63% who did not receive training.

If you’re looking to implement an employee financial wellness program

or would like a second opinion on your current framework, we invite you to set up a

FREE 20 minute consultation call with Saijal Patel, CEO of Saij Wealth Consulting.

Also check out our Saij Wealth Academy, a uniquely designed financial wellness program that’s

unbiased, impactful and inclusive.