Would you believe me if I said that you can become a millionaire and you don’t need to win a lottery to do it?

Well believe it. By investing – you can grow your money a lot easier than you think.

The magic is well, not really magical but rather a financial concept that I’ve followed, my parents have followed and many others who have been fortunate to learn about it early on. It’s called compound interest and is extraordinarily powerful in generating wealth.

Compound interest is when interest income builds on not only the principal amount (investment or payment) but also on the interest income accumulated from previous periods.

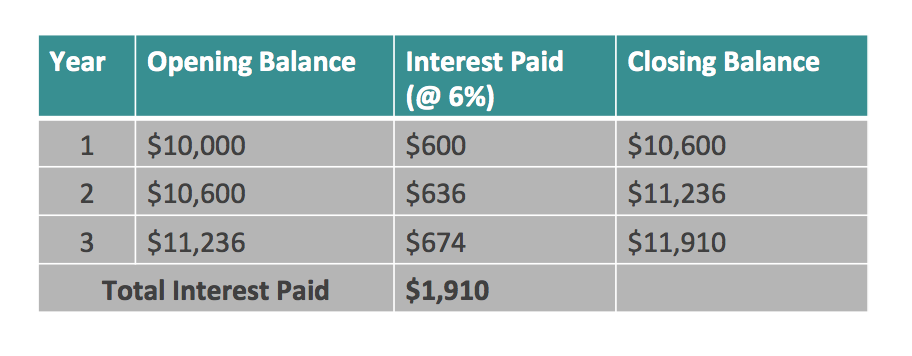

Here’s an example:

Suppose you were to invest an initial $10,000 and expect to generate 6% interest on your investment that will be paid annually. At the end of the year, you’d have $10,600 in your investment account. Now, that balance of $10,600 will earn 6% (as opposed to just $10,000) and then you’ll earn $636 in interest… and so on…You can see that in just a few years you’ve gone from collecting $600 in interest income to $674.

Suppose you were to invest an initial $10,000 and expect to generate 6% interest on your investment that will be paid annually. At the end of the year, you’d have $10,600 in your investment account. Now, that balance of $10,600 will earn 6% (as opposed to just $10,000) and then you’ll earn $636 in interest… and so on…You can see that in just a few years you’ve gone from collecting $600 in interest income to $674.

Now that you know what compound interest is, you also need to know that there are FOUR drivers to determining just how fast your wealth will grow:

- Your return on investment: I assumed a 6% return in the above example. I believe somewhere between 5-8% is a reasonable and sustainable rate one can expect over the long term for a relatively conservative and diversified portfolio. Of course, the more aggressive you are with your portfolio the higher the return you can make. However, you also risk losing money and are more susceptible to volatility. But remember, stashing your cash in a savings account that earns 0.5-1% is not going to help you build wealth fast.

- Compounding frequency: Interest can be compounded daily to annually depending on the financial product you buy (money market is daily but gives a low return, dividends are often paid quarterly, bonds usually pay interest semi-annually or annually). The more frequent the schedule the faster you’ll earn “interest on the interest”.

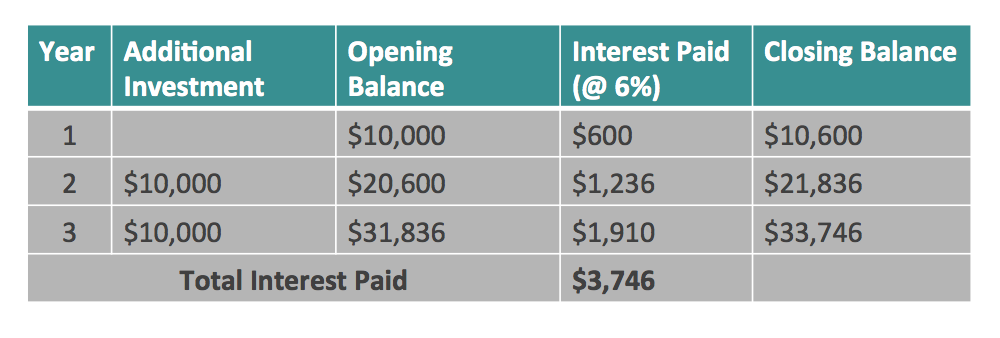

- Amount you invest and regularity: The more money you put towards investing the more income you’ll generate on the principal amount, and the more you’ll save. In the example below, I assume a lump-sum investment of $10,000 at the beginning of each year with the total opening balance earning interest.

If this was a “simple interest” calculation – in other words if you were to earn 6% on your original principal of $10,000 each year – you’d get $1,800 as shown in the first example. However, the compounding effect means you made $110 ($36+$74) more.

In this example, you made $146 more ($36+$110). You can see how quickly your money can grow!

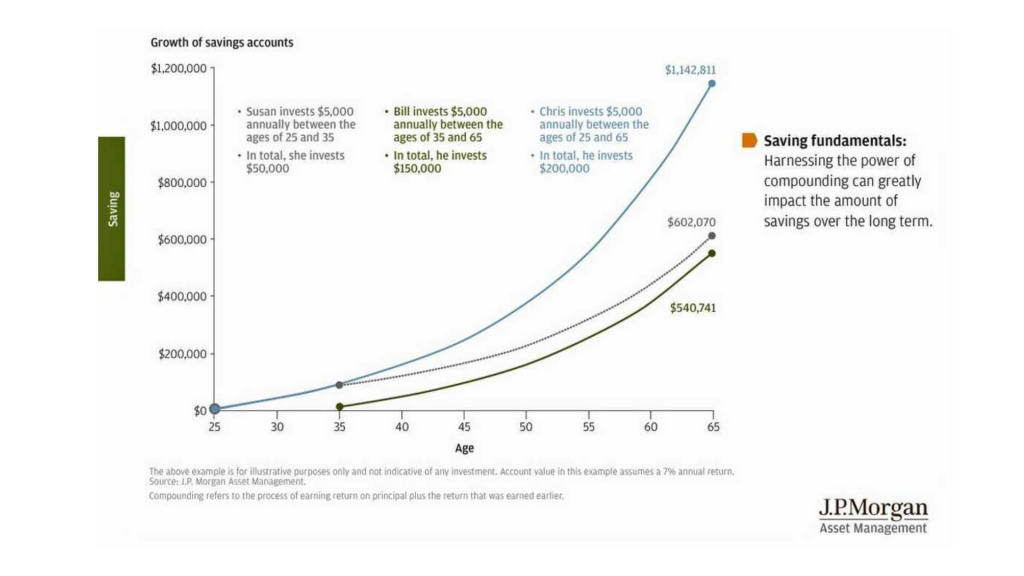

- The age you started: Based on the examples, I don’t have to tell you that the earlier you start, the longer time you have for the compounding interest magic to work and the more money you can make. In fact, did you know that those who start early and invest less are often well ahead of those who start later and invest more! This is the power of compounding interest and why I can’t stress enough why you must not delay investing.

See this chart below from JP Morgan:

You can see how even though Susan only invested $50,000 vs. Bill who invested $150,000, Susan has more money at retirement because she started earlier. Chris was diligent and invested every year and has almost double the amount Susan has.

You can see how even though Susan only invested $50,000 vs. Bill who invested $150,000, Susan has more money at retirement because she started earlier. Chris was diligent and invested every year and has almost double the amount Susan has.

So let me ask you, do you want to place your bets on winning a lottery and hope you’ll get rich, or do you want to put a bit of money away every year and be guaranteed you will be?