Every fall, human resources teams all around the U.S. work steadfastly to prepare employees for open enrollment.

Millions of American households use this period – typically between November and mid-December – to review their options and enroll in or adjust their health insurance plans, add dependents, or sign up for other benefits like dental and vision insurance, flexible spending accounts (FSAs), health savings accounts (HSAs), and sometimes, wellness programs.

But here’s the problem: Employers are so focused on ticking off their internal checklist – whether that’s evaluating plan options in the marketplace, negotiating with providers, or updating compliance – they miss an invaluable opportunity to not only support their workforce but to also make their jobs incrementally easier.

What am I talking about?

Many employers overlook the importance of leveraging financial literacy programs. And it’s not about offering any program—they need the right kind of financial education that empowers employees, drives real results, and supports both personal and company goals.

Why Your Open Enrollment Could Be Falling Short

The fact is many American employees have a limited understanding of how to make the most of open enrollment and workplace benefits, which inevitably has a profound impact on their financial well-being and can also affect employer retention.

A recent study by Equitable revealed that more than half of American workers (53%) regretted their benefit decisions because they didn’t adjust their benefits to reflect lifestyle changes, they were confused over available options, or they missed making changes before the deadline – likely because of overwhelm and indecision.

For those who sought a better understanding of their benefits, the same survey found that one in four relied on social media platforms and likely unregulated “finfluencers” for education, the trend being highest amongst Gen Z and millennials.

The cost to employees’ financial health and security cannot be underestimated.

Here are three common mistakes we see those in the workforce make:

Mistake #1: To keep premium costs low, many employees may underestimate the insurance coverage they need, leaving them ‘underinsured.’ Being unprotected in the case of an unexpected event puts them at financial risk they may not be aware of—ranging from incurring debt to delaying retirement savings.

Mistake #2: They often struggle to prioritize between important savings options like an HSA or a 401(k), leading them to make suboptimal choices. Lacking the tools to plan effectively, they may either fail to maximize their contributions or, in some cases, skip saving altogether, missing out on valuable tax benefits and long-term growth opportunities.

Mistake #3: They often do not understand how to strategically use a traditional 401(k) versus a Roth 401(k) to reduce their tax burden based on their individual financial situation. Lacking guidance, they miss the opportunity to optimize these accounts for both current and future tax savings, increasing the likelihood they’ll pay more taxes over time than necessary.

The Cost of Confusion on Employers

For employers, this lack of understanding is costly. When confusion and dissatisfaction with benefits directly affect an employee’s finances negatively, they in turn affect their emotional and physical well-being, their productivity, and ultimately their retention.

When employees feel confident in their benefits choices, job satisfaction improves, as high-quality, accessible benefits communication and education builds trust.

Year-round financial literacy programs to make open enrollment smoother and more transparent will ensure employees make better-informed decisions about benefits that align with their needs, and in turn boost their confidence.

Read my blog – “6 Mistakes to Avoid When Running Financial Wellness Programs.”

The Power of Effective Financial Education

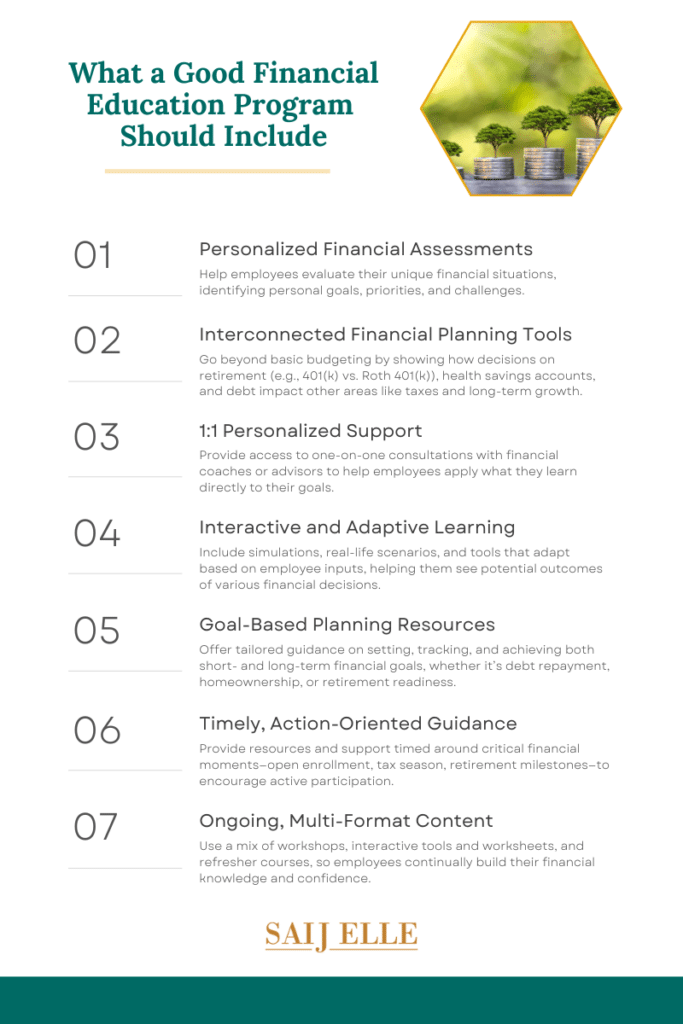

While there are many financial wellness programs available, it’s important to note, that not all content is created and packaged in a way that gets results.

Offering basic budgeting tools or general videos on retirement and debt management is a helpful start, but it doesn’t empower employees to confidently make complex financial decisions. While these resources are great for building foundational knowledge, they fall short of guiding employees from knowing how to take the right actions. Good financial planning requires understanding the interconnectedness of each decision—one choice can impact other areas, from savings and debt to taxes and retirement.

A truly effective financial education program equips employees with tailored, goal-oriented resources that address their unique financial situations. Combined with timely 1:1 support, this approach leads to smarter benefit decisions, reducing inaction and potential regret.

Corebridge Financial’s study shows that 68% of millennials and Gen-Z workers seek personalized guidance, and nearly half of baby boomers want more interactive tools.

How You Can Strengthen Your Employee Open Enrollment

To truly empower employees during open enrollment, it’s crucial to go beyond basic financial education. Offering the right, personalized guidance ensures employees not only understand their options but can confidently make informed decisions that align with their unique financial goals. With the right financial education program, you can help employees reduce uncertainty, avoid costly mistakes, and maximize their benefits, driving both individual and organizational success.

At Saij Wealth, we specialize in delivering tailored financial education that empowers female employees to make smarter, goal-driven decisions during open enrollment and beyond. Contact us today to learn how we can transform your open enrollment experience into a powerful tool for employee success.