When February rolls around I’m reminded that the RRSP contribution deadline is around the corner for Canadians. When I was working in the financial services industry many moons ago, this was our busiest time of the year. Since then, a lot has changed. For one, people are not rushing last minute to stash some money for retirement away but rather contributing to RRSPs throughout the year. Smart! And two, a close cousin of the RRSP – the TFSA was born in 2009. And what a great concept it is!

I still get a lot of questions as to whether anyone should bother with either of them, and if so which is the better of the two. For the first question, the short answer YES you absolutely should bother. For the second question, it depends.

I hope this article helps guide you in making the right decision.

What are RRSPs and TFSAs?

On a high-level, both Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) were designed to help Canadians save money for retirement and other important financial goals. The structure of these plans are more effective than a regular investment account, namely because by buying investments inside these vehicles, one can defer taxes until a later date or indefinitely. And by deferring tax, one has more money to take advantage of the effects of compounding which can mean hundreds of thousands of more dollars in your pocket! YOU HEARD ME!

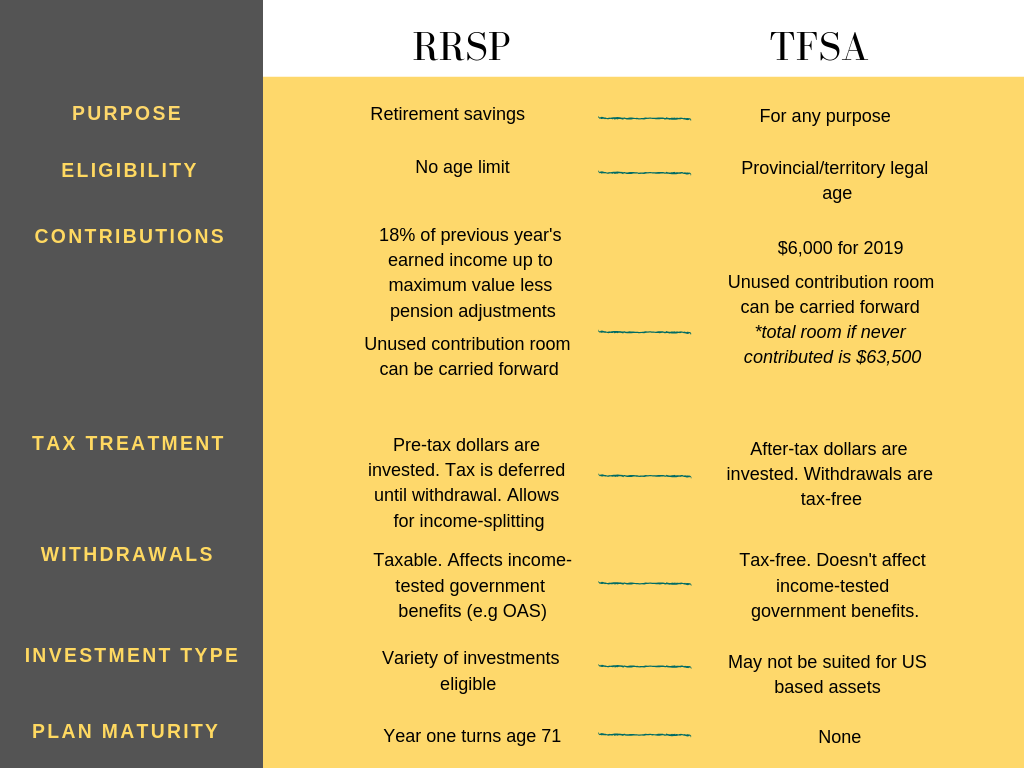

While there are differences between the two (see below), the tax-advantages they provide are what makes them a must-do, especially since Canadians pay a lot of taxes to begin with!

What I tell my coaching clients and audience is that ideally you want to maximize your contributions in both RRSPs and TSFAs. But sometimes that’s not possible, and there are certain circumstances in which doing so may not make sense.

So here are some points you should know in determining which is the ideal retirement vehicle for you.

Let’s go through this in more detail shall we?

The advantage of RRSPs over TFSAs

- Due to an up-front tax deduction with RRSPs, the higher your income bracket, the greater the tax benefit you’ll receive as a result of your contribution. And because any unused contribution room can be carried forward, you can be strategic in that you can contribute more in the years your income is higher, and less if you expect to be in a lower income tax bracket. Another strategy would be to make your allowable contribution but wait to claim some or all of the deduction when you’re in a higher-tax bracket. This way, at least your investment can grow on a tax-deferred basis in the meanwhile. There are no tax-deductions up front with TFSA contributions.

- RRSPs also allow you to reduce your tax liability now and in the future through income splitting using a Spousal RRSP. Suppose you are earning much more than your partner/spouse (yes, common-law partners and same-sex partners count). You can contribute up to your allowable limit to your partner’s plan under a Spousal RRSP. You get the tax deduction and when your spouse/partner withdraws money in the future, he or she will be taxed at his or her tax rate that is hopefully at a lower rate than yours. There’s nothing stopping you from contributing to your spouse/partner’s TFSA but there’s also no tax-benefit in doing so as it’s done on an after-tax basis.

- Relative to a TFSA, RRSPs typically have a higher contribution limit.

The advantage of TFSAs over RRSPs

- You have to have earned income in order to create contribution room towards to an RRSP whereas anyone over the legal age can contribute to a TFSA.

- You can withdraw money anytime from your TFSA without any penalties or tax implications. You also won’t lose the contribution room. You’ll have to wait a year to re-contribute the funds but you can carry forward unused contribution room indefinitely. While there’s no penalty if you withdraw from your RRSP early, you’ll be subject to tax and the contribution room will be lost for good. There are two instances where you can borrow from it tax-free and interest-free, and that is for:

- The Home Buyers’ Plan (HBP): Where first-time home buyers can borrow up to $25,000 to buy a home provided they repay it into the RRSP within 15 years.

- The Lifelong Learning Plan (LLP): To help fund you or your spouse if you want to go back to school. You can borrow up to $10,000 per year up to $20,000 max. This needs to be repaid over ten years.

- While you can contribute to a TFSA for as long as you live, you will be forced to close the RRSP by the end of the year you turn age 71. A majority of people will convert it to a Registered Retirement Income Fund (RRIF) where you’ll need to draw a regular income based on a formula. And so the tax-deferment for that portion ends. Converting it to an annuity or taking a lump-sum are other options.

- As seen in the chart, the income you draw from the RRSP/RRIF in retirement will affect Government income-tested benefits which means your government benefits like Old Age Security (OAS), Guaranteed Income Supplement (GIS) and Employment Insurance (EI) benefits can be clawed back. Any money withdrawn from a TFSA is not subject to such tests.

If you know that in retirement, you’ll be in a high or higher income tax bracket than you are now, a TFSA may be better suited for you because all your withdrawals and income earned on your investments will be tax-free at the time. You may be hit with a higher tax payment with an RRSP (converted to a RRIF) if the amount accumulated is a big amount.

You’ve seen the pros and cons above but I’ll leave you with this thought: No one really knows what their personal tax situation and especially our country’s tax laws will be 10, 20 or 30 years from now. And for that reason, I’m hedging my bets and contributing to both! I advise most to do the same.

Questions? Feedback? I’d love to hear from you!