The rise in popularity of Exchange-Traded Funds (ETFs) has been exponential – and for good reason. ETFs can provide a low-cost way to diversify your portfolio while maintaining flexibility and liquidity.

If you’re one of the many investors considering investing in ETFs, there are a few key things you need to know before diving in.

What are ETFs?

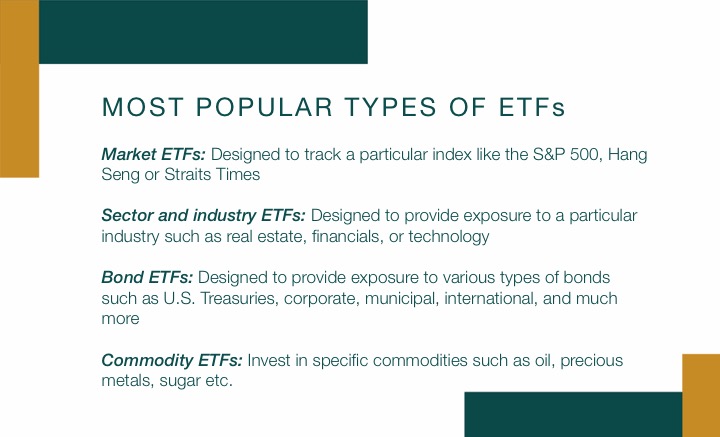

An Exchange-Traded Fund (ETF) is a basket of securities, or an investment fund similar to a mutual fund. They’re offered in a variety of asset classes (stocks, bonds, commodities, currencies etc.,) AND numerous industries and markets. There are even fancy strategy-type ones that allow investors to make money when markets fall or avoid certain type of taxes. The main difference between ETFs and mutual funds though, is that you can buy or sell ETFs through a brokerage firm during the day on a stock exchange.

Here are the three things you should know before buying ETFs:

ETFs are a great way to build a diversified portfolio

Diversification is the most important rule in investing, and ETFs can help. If you’re not sure how it works, read about why here.

There are literally thousands of ETFs available to invest in – and they cover every major market (the S&P 500 and Nasdaq in the U.S., the Hang Seng in Hong Kong, Sensex in India etc.,) every type of industry (technology, banks, commodities, real estate etc.,) as well as types of stocks (small-cap, growth etc.). There are ones that cover bonds (fixed-income), and some ETFs will even pay dividends if you want regular income from your investments.

With a vast selection to choose from, you can use a handful of ETFs to create a portfolio that gives you exposure to different assets and helps you better manage risk.

Understand the real costs of buying ETFs

Who doesn’t like to save money? I certainly do. While I can’t control what kind of returns I’ll get on my investments, I can control how much I’ll pay for them. ETFs are often – but not always, cheaper than mutual funds.

Generally, the fees for mutual funds can vary from 0.01% to 10% whereas the expense ratio for ETFs range between 0.10% to 1.25%.

Of course lower costs means more money in your pocket, however it’s important to understand the value you’re receiving by buying ETFs and any limitations related to specific ones. For one, a low expense ratio for an ETF may be because it doesn’t trade as often as others so there’s less liquidity (and it could be harder to buy or sell). Some ETFs with low fees may have a greater “tracking error” meaning its tracking of a market or index is not as precise as other ETFs, which could affect its performance. And lastly, the more exotic or focused the ETFs, the more expensive they’ll be.

If you hate taxes…

And if you’re in a country that taxes investment gains, owning ETFs has its advantages.

There’s very little buying or selling of the underlying assets in an ETF unless the index it’s tracking has changed – in which case an unlikelihood capital gains will be triggered.

This is different than actively managed mutual funds, where the manager has to constantly buy and sell stocks. Also if an investor of a mutual fund wants to cash out, the manager has to sell assets in order to pay that investor – which can produce capital gains. With ETFs, you simply sell your units to another buyer.

Note that when you purchase ETFs through brokerage you’ll need to pay commission fees on each trade or transaction. So, if you plan on purchasing small amounts of an ETF on a regular basis, these commissions will eat into your returns and likely not justify this type of strategy. In this case, mutual funds may be a better bet. However, if you’re willing and have the cash to buy a lump sum and not regularly trade, ETFs may be a smart choice.

Not all ETFs are packaged the same

There are numerous providers who will have what looks to be similar ETFs to offer. For example, Company A and Company B will have ETFs that mimic the S&P 500 index in the U.S. However upon closer examination of the holdings and percentage bought of each, you’ll uncover differences. This can lead to difference in performances between the two types of ETFs. While it’s difficult to predict which one will do better, this is a nuance to be aware of.

Where it becomes more relevant is when ETFs are “leveraged” or “hedged”. What does this mean? Well, when an ETF is leveraged, they use debt to try to multiply gains earned by a particular index. It sounds great, except that also means it could lead to much bigger losses as well. So in short, you’re taking on more risk with this type of ETF compared to one that merely tracks the index.

An ETF that is hedged usually uses a type of contract (futures) on currencies to help manage the risk in foreign currency volatility. There’s nothing wrong with this, and in fact hedged-currency ETFs have been drawing more and more investors over the years. But be aware that there’s now an added layer in determining the performance. Deciding to go hedged or buy an ETF that’s non-hedged will depend on where you think that foreign currency is likely to trade.

An ETF that is hedged usually uses a type of contract (futures) on currencies to help manage the risk in foreign currency volatility. There’s nothing wrong with this, and in fact hedged-currency ETFs have been drawing more and more investors over the years. But be aware that there’s now an added layer in determining the performance. Deciding to go hedged or buy an ETF that’s non-hedged will depend on where you think that foreign currency is likely to trade.

So to wrap up, ETFs are becoming known as the “go-to” investment because of their flexibility, efficiency and the plethora of options to choose from. When deciding if they’re right for you, consider how frequently you want to invest and trade ETFs, and what your approach will be in building a portfolio. You should feel comfortable in choosing they type of ETFs you want to buy. But if not, the good news is that there are a growing number of advisors who are recommending them for their clients and can help.