Talking about death sounds morbid, I know. No one likes to think about the inevitable and end of life planning.

But the reality is that time will eventually come, and women who typically outlive men will have the last say on how they’d like their wishes carried out and how they want to leave a legacy.

This is why a “death file” and an “end of life planning checklist” is so important.

While nothing will replace the hole that’s left, ensuring that important documents are organized will help those grieving sort your financial affairs without stress and disagreements. It will also help avoid costly legal fees or even prevent the denial of your inheritors’ access to money.

What’s a death file?

The idea to end of life planning is to have all your important papers and key financial information in one place for your executor and heirs to settle the estate.

Your “death file” can be physical documents that are safely guarded (in a fireproof safe box), or electronic files on a shared drive on a computer (that’s password protected) or USB thumb drive, or a combination of both.

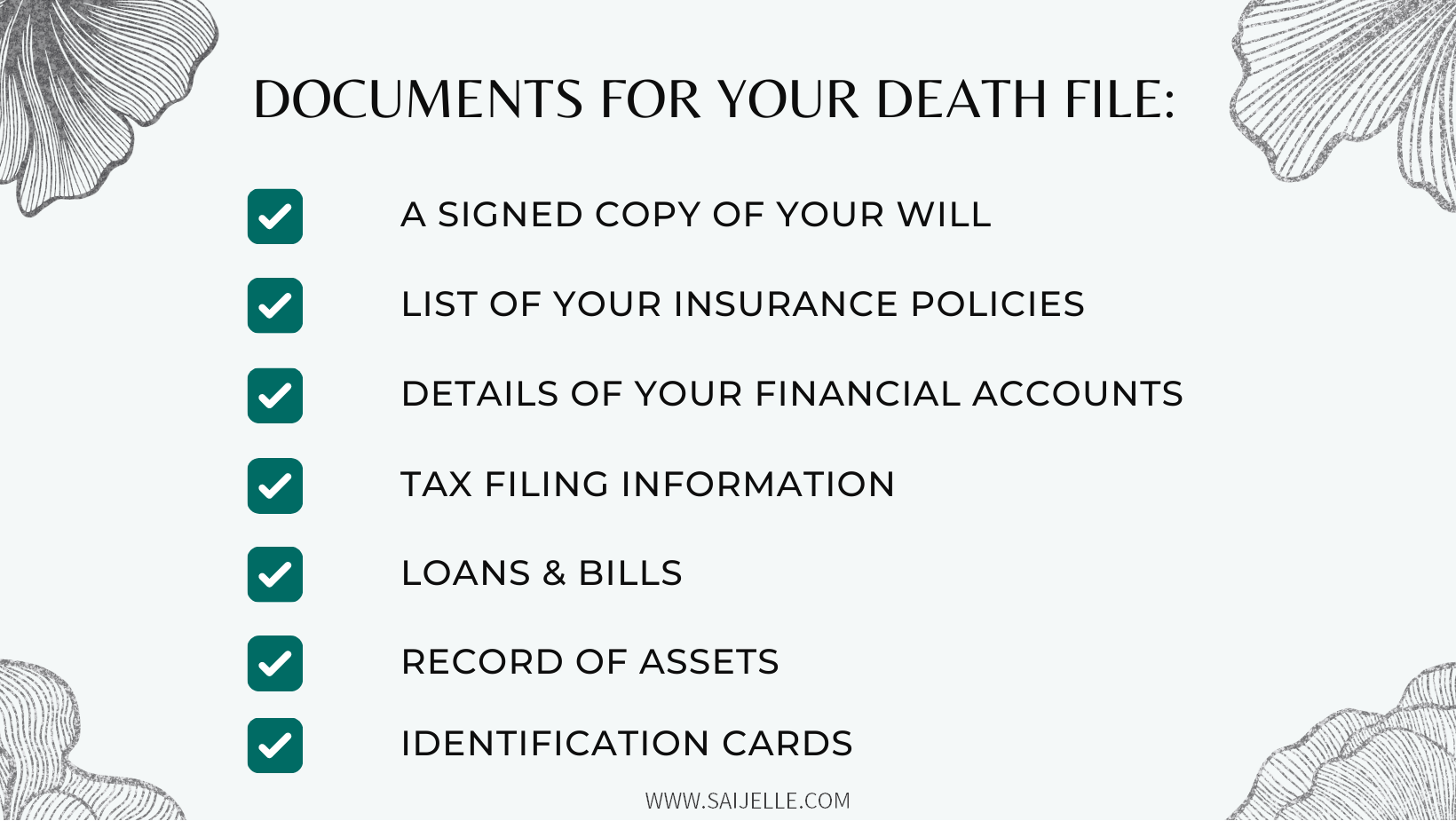

End of Life Planning Checklist

To start getting your death file together, here’s an end of life planning checklist of what you should have:

1. A Signed Copy of Your Will

This is of utmost importance as it is a legal document that states your wishes on how you’d like your estate distributed, who you’d like to facilitate your wishes and who will be guardian of your minor children (if any). It will also prevent having a lengthy probate process.

Be sure to keep the most recent version, as well as the details of the attorney who drew it up and the executor(s) named in your will.

* Your will may be accompanied by a Power of Attorney and/or Trust, and if so you’ll want to keep those documents together with the will.

2. A List (And Copies if You Have) of Your Insurance Policies

Gather information on all insurance policies that you own (personally and from work).

- Life insurance: Include the policy number, beneficiary, cash value of the policy, and other specifics.

The beneficiary will be required to present a copy of the death certificate in order to make a claim, and they can expect the death benefit to be paid within 30-45 days.

- Car, home & health insurance: Keep detailed information on those as well as these will need to be cancelled or transferred into a different name.

3. A List of Your Financial Accounts

These include bank accounts (chequing/savings), investment accounts (at banks, advisory firm or self-directed), annuities (at life insurance companies, banks or advisory firm), pensions (with the government, advisory firm or work), and mortgage (broker or bank).

Keep either copies of statements or a spreadsheet with information of all your accounts. Make note of the location of these accounts, the account numbers, the name/names it’s under, the beneficiary of the accounts and contact details of the account representative or advisor.

This will help your executor/heirs manage them – whether that is to close the accounts (if it’s solely in your name), transfer the account (if in joint name), or consolidate the accounts.

4. Tax filing Information

Your executor will need to file one final tax return on your behalf, so it will be important to keep the necessary papers and slips together.

These include past tax returns (up to seven years), slips for salary or business income, property income, government support (i.e. CPP, QPP, GIS, OAS if in Canada) and investment income, charitable donations, and medical receipts.

5. Loans & Bills

When one dies, the estate is responsible for paying credit card balances and other debts. Keep a list of the account details for your utilities, all your credit cards, and loans.

Note, that if these accounts are in joint name (co-signed), the surviving member will very likely be responsible for paying the balance.

6. Records of Assets

Keep papers that show proof of ownership of your:

- car

- home

- investment properties

- business

- ..and more

7. Identification Cards

Closing accounts is important to help prevent fraud. Such things as health insurance coverage, passports, government identification (drivers license, social insurance or security card) must be cancelled so keep photocopies of all these in a safe place in case your executor can’t access the originals.

If you are married or divorced, be sure to keep your marriage certificate, divorce decree and custody papers as well.

8. Sharing Access

Once you’ve set up your “death file”, you’ll need to tell your loved ones you’ve actually done it and where to find the information.

Note that while many believe a safe deposit box is a good place to keep these documents, it’s not always easy to access unless you’ve set up joint access.

Create a password list for your email, social media accounts and phone. Consider using a password software like LastPass that lets you pass your passwords to your executor or heir.

Rather than sharing your password with your spouse or trusted family member, you may want to consider naming another person on one bank account.

This way, if they need to make a bill payment, they can do so without delay or disruption. An account in your name alone typically will not be accessible to the executor until the will is probated.

How do you know if you have your estate plan set up correctly?

Well, you’re in luck because my comprehensive online financial planning and education program for women will teach you what you need to know about estate planning, protecting your wealth, investing and much more.